Investor relations

About Blipply

Headquarter

Stockholm, Sweden

Team locations

Sweden, Kenya, Vietnam

Why invest

High-growth opportunity at the intersection of AI and finance

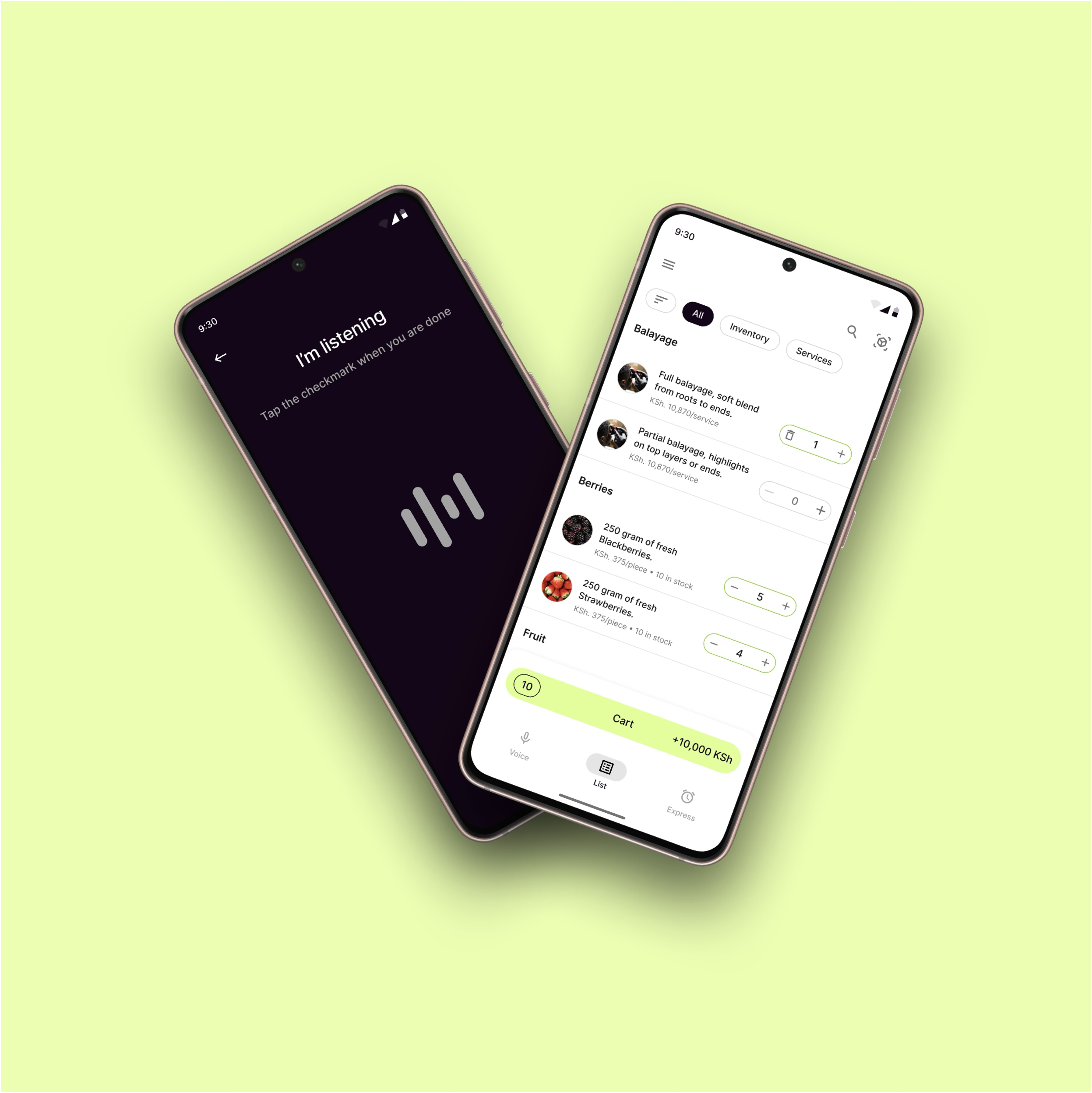

Blipply is a Swedish AI company building financial profiles for unbanked and underserved people in emerging markets. Our technology bridges the gap between unbanked individuals and credit, insurance and other relevant providers, unlocking access to essential services that have long been out of reach.

Blipply is the smarter way to money, designed for the world’s informal economies.

Our mission

At Blipply, we are on a mission to change how people access financial opportunities through technology. Just like mobile money transformed everyday transactions, we believe the next breakthrough will come from tools that are simple, trusted, and made for real people.

Right now, millions of informal merchants and consumers are blocked by systems that are too expensive, or not designed for them. As digital commerce and payments grows, so does the gap. We are here to close it. We are building a future where access, speed, and trust are not features. They are the starting point.

If that sounds like something you want to be part of, you’re in the right place.

Get more info

We are continuously raising growth capital to scale.

Why invest? Emerging markets are driving the next decade of growth in consumption, digital lending, and financial inclusion. Blipply is positioned at the intersection of all three, with real traction and AI infrastructure that’s built to scale.

If you believe the next billion borrowers will come from the streets, markets, and stalls of the informal world, not from branches, spreadsheets or mature markets, reach out now.